Posts Tagged ‘financial performance’

Powerfully Executing for the Upturn

Unrewarded Heroic Efforts in Adverse Markets

Curve Ahead

Nobody Saves Their Way to Success

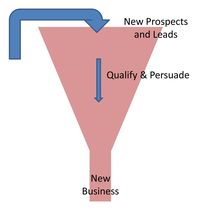

Businesses grow and win because they invest in areas that make them more unique, and more special. They do not succeed because they invest their cash so that they can save overhead. So how should we be investing in our businesses so they emerge better and stronger? There are three basic parts to the process.

The Resilient CEO

When adversity hit, these leaders battled back and gave us all something to learn. Inside Alliance private working groups, we hear with some regularity jaw-dropping events that land on the chief executive’s desk. Sometimes they are simply challenging opportunities, but often they are disasters that threaten the survival of the business.

Outlasting Hard Times

Hard times can befall a business for many reasons, of which the economy is only one. If you look objectively at the situation and find your environment in a temporary downturn, your goal is to outlast that downturn and have a strong company when good times return. Here are the tactics you use before the downturn hits.

Robert Sher is founding principal of CEO to CEO, a consulting firm of former chief executives that improves the leadership infrastructure of midsized companies seeking to accelerate their performance. He was chief executive of Bentley Publishing Group from 1984 to 2006 and steered the firm to become a leading player in its industry (decorative art publishing).

Robert Sher is founding principal of CEO to CEO, a consulting firm of former chief executives that improves the leadership infrastructure of midsized companies seeking to accelerate their performance. He was chief executive of Bentley Publishing Group from 1984 to 2006 and steered the firm to become a leading player in its industry (decorative art publishing).