Posts Tagged ‘financial performance’

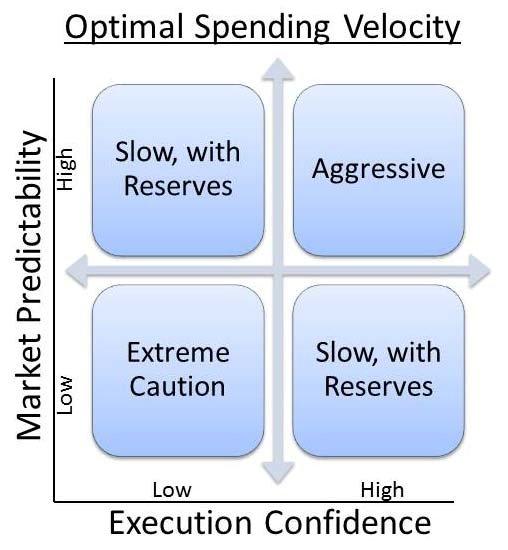

Avoiding Growth That Leaves You Broke (Part 3) Calculating the Odds of Successful Execution

CEO Experience Navigating Fiscal Cliffs: Lessons for Washington?

Mid-market CEOS are experts at managing fiscal cliffs, unlike Washington which has us teetering on the edge, and as of today, most likely falling off the cliff head over heels.

I did some thinking about the lessons that VC backed CEOs could teach Washington, and have written my latest post on just that subject.

The Lesson of H-P for Mid-Market Companies

Attempted Growth Can Leave You Broke: Part II

When Shooting for Growth Can Leave You Broke

Google Can Survive Too Much Innovation. You Can’t.

For a mid-market company, choosing where to place your innovation bets is a dangerous game. Where you spend your time and invest your dollars are decisions that can make or break you. How much time should a CEO and his team invest in looking at “new ideas?” And how does a CEO select the most promising innovations and ignore the rest?

How Did Your Mid-Market Company Run Out of Money?

Defying Gravity: Preparing for the Inevitable Downturn in Your Core Business

Nearly every successful middle-market company eventually faces a swarm of competition. When their core business contracts, single-product companies can find themselves fighting for their lives. But the companies which plan highly-related diversifications before such downturns grow in good times and bad.

Robert Sher is founding principal of CEO to CEO, a consulting firm of former chief executives that improves the leadership infrastructure of midsized companies seeking to accelerate their performance. He was chief executive of Bentley Publishing Group from 1984 to 2006 and steered the firm to become a leading player in its industry (decorative art publishing).

Robert Sher is founding principal of CEO to CEO, a consulting firm of former chief executives that improves the leadership infrastructure of midsized companies seeking to accelerate their performance. He was chief executive of Bentley Publishing Group from 1984 to 2006 and steered the firm to become a leading player in its industry (decorative art publishing).