It’s Your Choice. Make it.

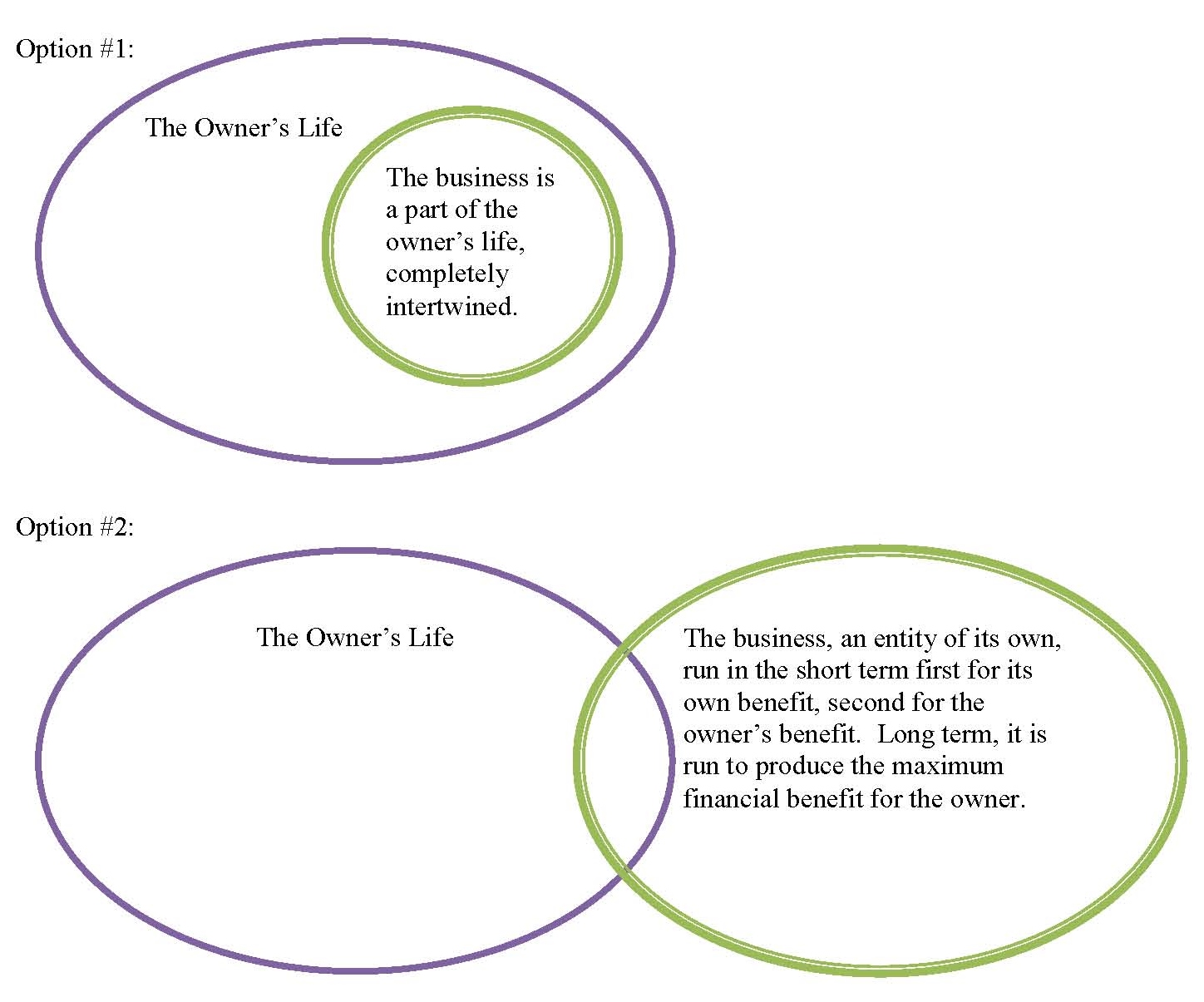

Here is the fundamental choice for owners of closely held companies:

Option One: Incorporate the business into an owner’s life, even though the business will likely not be as vibrant and profitable, but it’s fun for the owner. It’s the way he wants it to be and it serves him well. Odd hours, yelling and screaming when he’s pissed, employee turnover, pulling perhaps too much out of the business to fund toys and vacations are all okay in this model, so long as he gets what he needs, and doesn’t kill the business that is providing the cash flow.

Option Two: To run the business as it should best be run, as its own living being, maximizing productivity and cash flow, then spend the fruits of that labor on your own separate life as you see fit. This is the model you’d want if you were just a stockholder, with hired management—this is the way you’d want them to run the business. And in fact, I have a few clients that have run their businesses well, and are phasing in a hired President to handle the full time work responsibilities so they can go part time and play much more.

This essay is written for owners and leaders of businesses that want to, or are choosing Option Two. But it can be a difficult choice. Sometimes partners in a business can be split on choosing option one or two. Sometimes owners say they want option two, but keep acting out the option one script. Sometimes an owner hires a President and tells her to run option two, but keeps jumping in with option 1 actions, creating havoc.

Here is my Bill of Rights and Responsibilities for Owners of closely held companies.

Owners Rights:

- To make lots of on-going money when the business can generate it.

- To have the business run for the benefit of the owners. That doesn’t always mean growth.

- To sell the business someday and make lots of money.

- The right to make the big decisions—board of director type decisions, and to have the business give you information to make those decisions.

Note: (This is not a list of CEO rights, which is quite different, or manager’s rights, which is different still).

Owner’s Responsibilities:

- Putting money back in from time to time to maintain the business so it’s there for the good years.

- Accepting risk (like personal guarantees, and taking pay cuts in tough times).

- To keep sufficient personal liquidity and net worth to be able to fulfill these responsibilities.

- To stay or become financially stable, so as not to become a burden to the business or to create pressure on the business to make short term decisions for the benefit of the owner, to the detriment of the business.

- In the case of multiple owners, to insure their goals stay aligned, and if they drift, to deal with the differences early on, and in a planned fashion.

- To stay knowledgeable about the industry and business conditions.

- To provide clear vision as to the long term future of the business.

- Hiring, firing, and controlling the CEO. (and that could be yourself).

Hey look! The list of responsibilities is longer than the list of benefits. Owning your own business is not for everyone.

I said above that a legitimate right of an owner is to have the business run for the benefit of the owner. So what’s with all the “rules” then? What I mean by “for the benefit of the owner” is that the owner gets to choose among all of the sensible strategic choices the business can make that will produce results closest to what the owner would like.

Let’s say there are two partners in a 40 million dollar revenue insurance business, and they are getting plenty of income and enjoying life. They certainly could start buying competitors and otherwise rapidly grow the business, but that would require re-investing the cash they’d been pulling out to play. Then the business would NOT be run for the benefit of the owners. The business would have lost sight of the reason the owners created the business in the first place.

On the other hand, if the business was slipping, margins going away, and the best option to keep it healthy was to scale up (say the industry was in consolidation). The owners might sacrifice their play for a few years to keep the business healthy, so that at a 200 million run rate, it will again generate the personal income to allow them to return to their desired level of play.

Yes, there are a thousand wrinkles in this seemingly simple matter. This domain is heavily influenced by emotions and desires as humans, and is about as far away from a spreadsheet as can be. Mix family into a business and the complexity grows still more.

It’s your choice to make—Option One or Option Two. But a word of advice: If you need someone else to make the choice so your life can improve, don’t print out this article and shove it in front of them. I’ve tried that approach, and it doesn’t work. The choice is mostly emotional, with some intellectual support. Think carefully about how to help them make the right choice emotionally, then patiently pursue that path.

Tags: business acumen, closely held, owner business alignment

Robert Sher is founding principal of CEO to CEO, a consulting firm of former chief executives that improves the leadership infrastructure of midsized companies seeking to accelerate their performance. He was chief executive of Bentley Publishing Group from 1984 to 2006 and steered the firm to become a leading player in its industry (decorative art publishing).

Robert Sher is founding principal of CEO to CEO, a consulting firm of former chief executives that improves the leadership infrastructure of midsized companies seeking to accelerate their performance. He was chief executive of Bentley Publishing Group from 1984 to 2006 and steered the firm to become a leading player in its industry (decorative art publishing).